Financial Services

Customers love credit unions and community banks -- but still end up taking their most significant business to bigger banks.

How Bank Central Asia grew into one of Southeast Asia's largest and most profitable banks after the crisis of 1997.

Marketers faced many challenges in 2015, and Gallup covered some of the most significant ones, such as Volkswagen's emissions scandal.

To engage millennials, financial leaders need first to understand what is -- and isn't -- true about their banking behaviors.

Digital financial services are instrumental in improving women's financial autonomy and economic participation. There are vital steps that women, governments and the private sector can take to boost this financial inclusion.

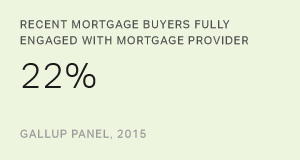

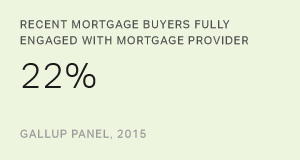

By improving the mortgage approval and closing processes, as well as overall service, banks can alleviate customer frustration.

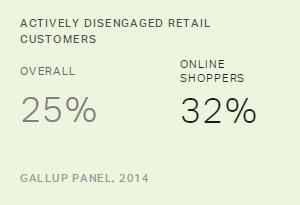

By disengaging customers, banks are losing opportunities to win future retail and mortgage business, as well as referrals.

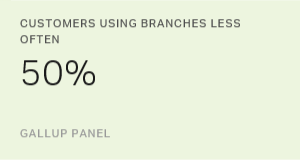

Online banking may decrease costs for banks, but it could result in lower customer engagement and revenue loss.

Providing better customer service in call centers does not mandate higher costs and longer call times.

Only 13% of American smartphone users have digital wallets. Providers in this market are largely failing to provide compelling value propositions that get consumers past their concerns about security, convenience and practicality.

Apple can, however, take solace in the fact that its digital wallet far outpaces competitors in customer engagement and usage.

Read how digital wallet providers can gain the greatest number of early adopters and possibly go on to dominate the marketplace.

Apple, Google, PayPal and banks are rushing full speed into the digital wallet market. But what do users want?

Americans still love to hate the banking industry. Almost seven years after the financial crisis, confidence in banks as an institution remains low. The industry has largely been unable to change the public's negative perception.

Customers at acquired banks leave at a much higher rate than the average annual attrition rate across the industry.

When customers strongly agree that their bank looks out for their financial well-being, 84% are fully engaged.

Digitizing payments and formalizing saving practices could boost financial inclusion worldwide.