ಟ್ವೀಟ್ಗಳು

- ಟ್ವೀಟ್ಗಳು

- ಟ್ವೀಟ್ಗಳು & ಪ್ರತಿಕ್ರಿಯೆಗಳು

- ಮಾಧ್ಯಮ

@jessefelder ತಡೆಹಿಡಿಯಲಾಗಿದೆ

ನೀವು ಖಚಿತವಾಗಿಯೂ ಈ ಟ್ವೀಟ್ಗಳನ್ನು ನೋಡಲು ಬಯಸುವಿರಾ? ಟ್ವೀಟ್ಗಳನ್ನು ನೋಡುವುದು @jessefelder ಅವರನ್ನು ತಡೆತೆರವುಗೊಳಿಸುವುದಿಲ್ಲ.

-

ಪಿನ್ ಮಾಡಿದ ಟ್ವೀಟ್

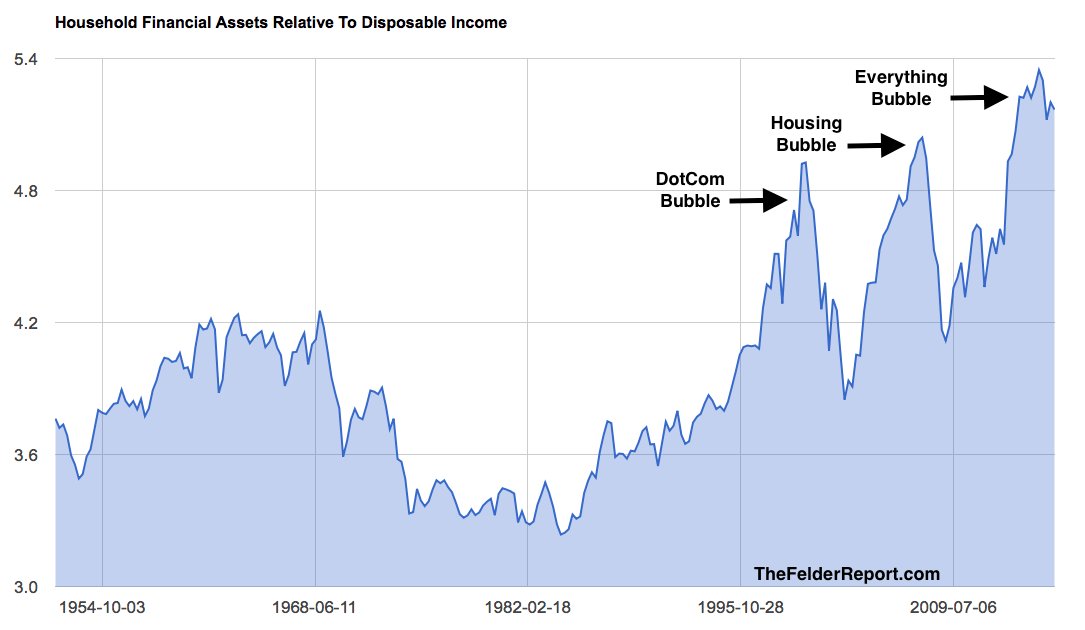

NEW POST: What's A Prudent Investor To Do? https://www.thefelderreport.com/2017/02/22/whats-a-prudent-investor-to-do/ …pic.twitter.com/waoSq8tM17

-

Jesse Felder Retweeted

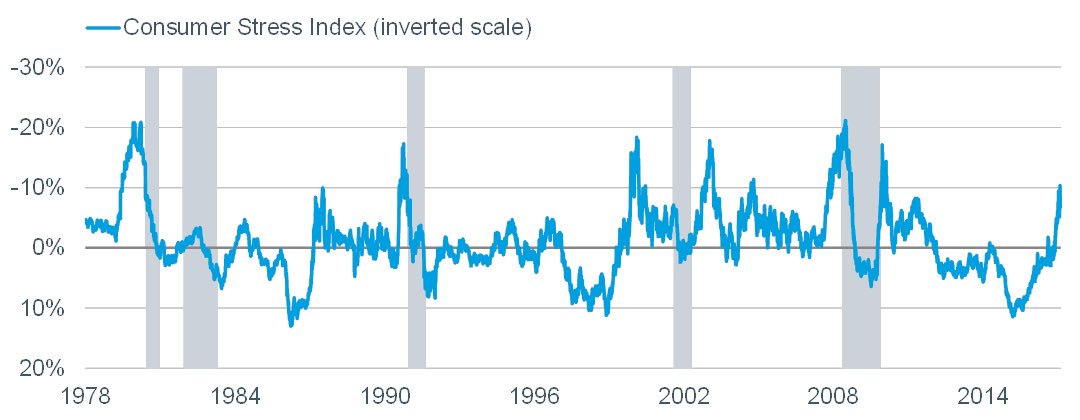

My (proprietary) Consumer Stress Index showing rising stress on consumers, courtesy of inflation-oriented componentspic.twitter.com/jH5vqZ4lOZ

-

Jesse Felder Retweeted

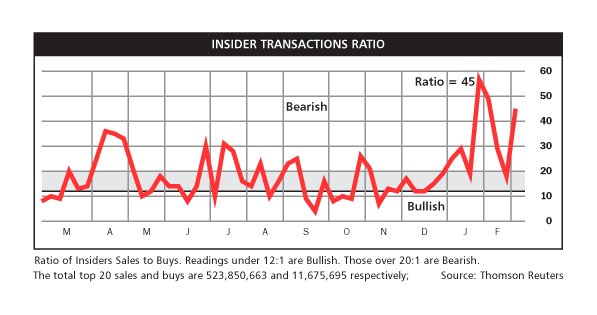

Hmmm. Insiders sold $7.8bn of US stock in February (most in 6 yrs) while buying only $380m. Not positive. h/t

@TrimTabsIR -

Jesse Felder Retweeted

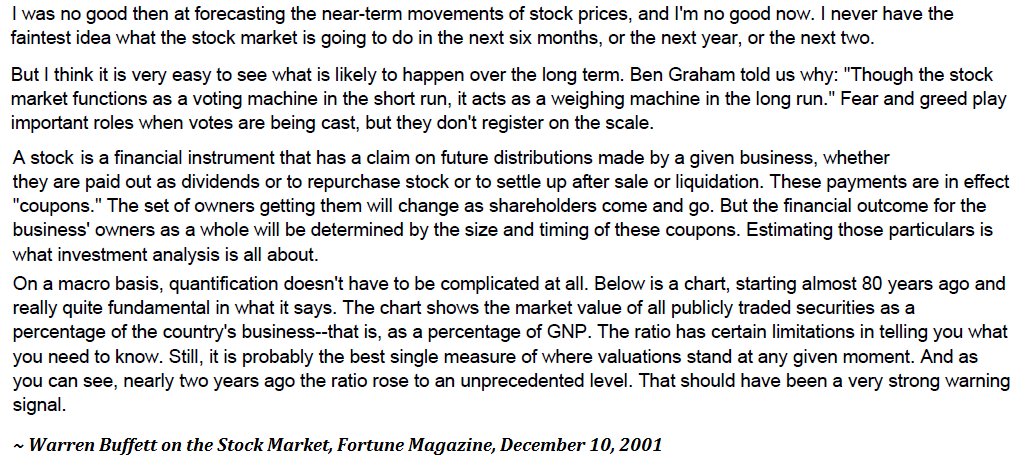

I long for the days when Warren Buffett actually spoke like Warren Buffett. Value investors never ignore how expected cash flows are priced.pic.twitter.com/XJMrboFEBN

-

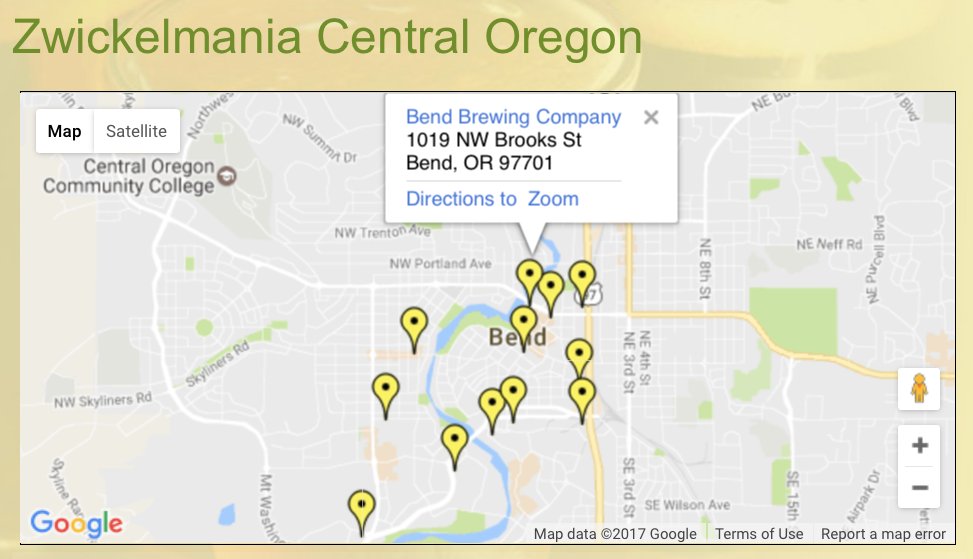

So much beer, so little time...

#zwickel17#inbendpic.twitter.com/cix7U7JpGX

-

My latest free weekend email report just went out -http://eepurl.com/cDFPHD

-

Jesse Felder Retweeted

Prospective 12-year total returns for a passive, conventional portfolio mix just dropped to the lowest level in history.pic.twitter.com/IGRLgO4jZP

-

Jesse Felder Retweeted

-

Jesse Felder Retweeted

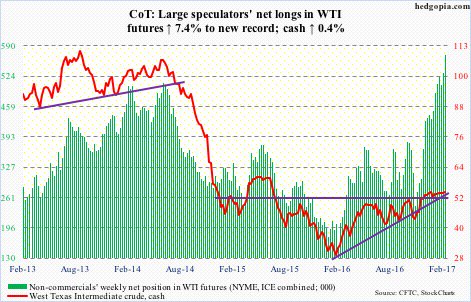

Yet another wk, yet another record.

#Hedgefunds' net longs in#WTI futures ↑ 7.4% to new high. Yet another weekly doji on cash.#crude$XLEpic.twitter.com/EtfpODQehT

-

Jesse Felder Retweeted

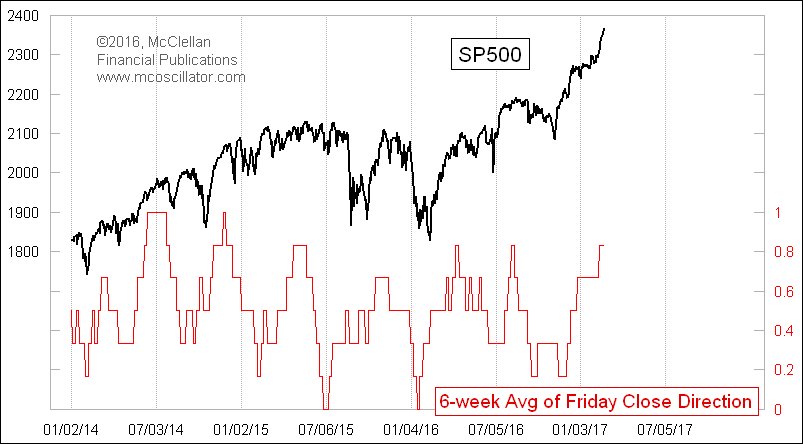

Market trying hard to close up on Friday. 5 of last 6 Fridays were up for SPX, which is a sign of complacency about weekend event risk.pic.twitter.com/IM7ZCuSXNp

-

Jesse Felder Retweeted

Meanwhile, you can still get a 7.6% discount on your gold at CEF...pic.twitter.com/YlhbIE03uC

-

Jesse Felder Retweeted

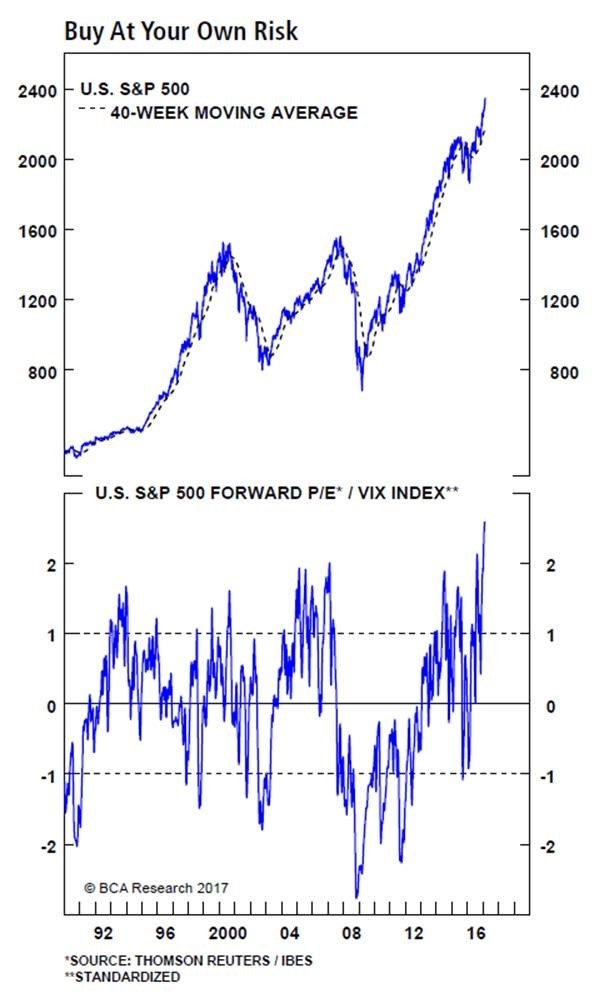

ratio of S&P 500 forward P/E &

#volatility at an all time high$VIX$SPX$SPY https://blog.bcaresearch.com/what-does-the-sp-500s-forward-pe-controlled-for-volatility-signal …pic.twitter.com/vEAkSzG8zJ

-

Or just a bit more humility and understanding of its limitations?http://app.ft.com/content/331ff894-f876-11e6-bd4e-68d53499ed71 …

-

More on the two topics from

@Skrisiloffhttp://avondaleam.com/company-notes-digest-2-24-17/ … -

Eric Cinnamond on consumer strength (or lack thereof) and inflation trends in recent earnings reports: http://ericcinnamond.com/consumer-update/ …

-

Jesse Felder Retweeted

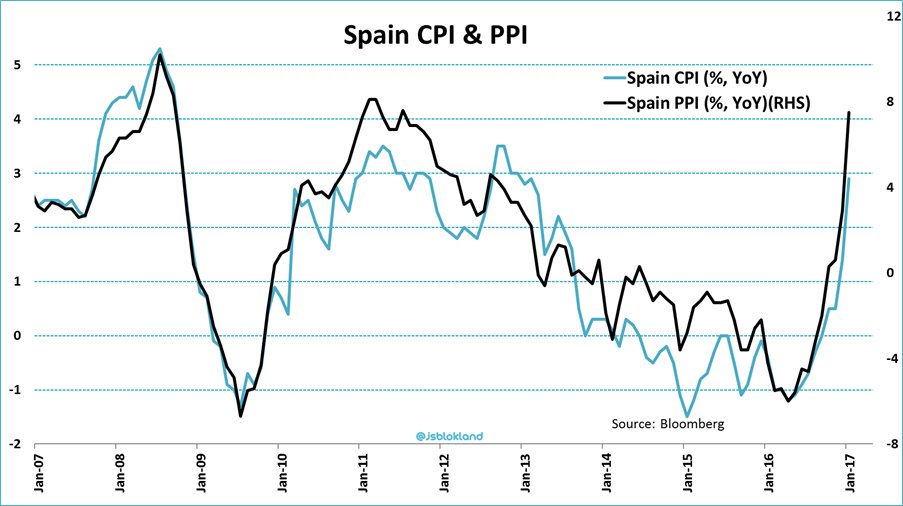

WOW! Missed this one.

#Spain's producer prices rose by a massive 7.5% YoY in January.pic.twitter.com/zuxzn0kjPn

-

Jesse Felder Retweeted

"The goal of investing is to find situations where it is safe not to diversify" – Charlie Munger

-

Jesse Felder Retweeted

Macro hedge funds finally all-in equities. Most long since July 2015. Back then, China-induced sell-off followed.pic.twitter.com/ciuyzF8BTn

-

Jesse Felder Retweeted

GDXJ vs. GDX, often a leading-indicator for

#gold and the#miners, is trading at new bull-market highs#WILTWpic.twitter.com/Qh6oA1mEOS

-

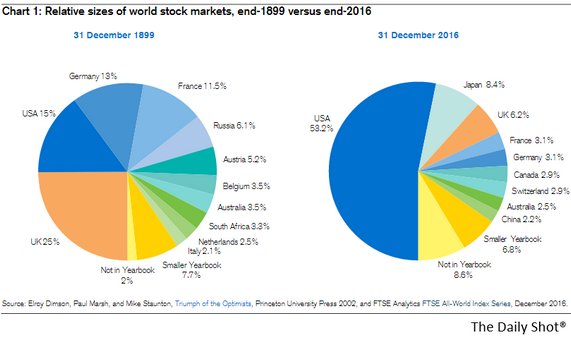

Relative sizes of world stock markets in 1899 and 2016 http://blogs.wsj.com/dailyshot/2017/02/22/wsjs-daily-shot-the-feds-ides-of-march/ … via

@SoberLookpic.twitter.com/HGEPbjAdqN

-

'Some hedge funds are worried but riding the market seems safer than selling out or shorting it'https://www.wsj.com/articles/big-investors-are-too-scared-to-run-too-scared-to-fight-trump-rally-1487851201 …

ಲೋಡಿಂಗ್ ಸಮಯ ಸ್ವಲ್ಪ ತೆಗೆದುಕೊಳ್ಳುತ್ತಿರುವಂತೆನಿಸುತ್ತದೆ.

Twitter ಸಾಮರ್ಥ್ಯ ಮೀರಿರಬಹುದು ಅಥವಾ ಕ್ಷಣಿಕವಾದ ತೊಂದರೆಯನ್ನು ಅನುಭವಿಸುತ್ತಿರಬಹುದು. ಮತ್ತೆ ಪ್ರಯತ್ನಿಸಿ ಅಥವಾ ಹೆಚ್ಚಿನ ಮಾಹಿತಿಗೆ Twitter ಸ್ಥಿತಿಗೆ ಭೇಟಿ ನೀಡಿ.

Jesse Felder

Jesse Felder Liz Ann Sonders

Liz Ann Sonders John Authers

John Authers John P. Hussman

John P. Hussman Helene Meisler

Helene Meisler

hedgopia

hedgopia Tom McClellan

Tom McClellan La nuit sera calme

La nuit sera calme Babak

Babak jeroen blokland

jeroen blokland Ivan Maljkovic

Ivan Maljkovic Martin Enlund

Martin Enlund 13D Research

13D Research